National Cancer Institute under scrutiny over financial mismanagement

The auditor general has reported several inaccuracies, including unsupported expenditures, inaccuracies in financial statements, and arithmetical errors in budget comparisons.

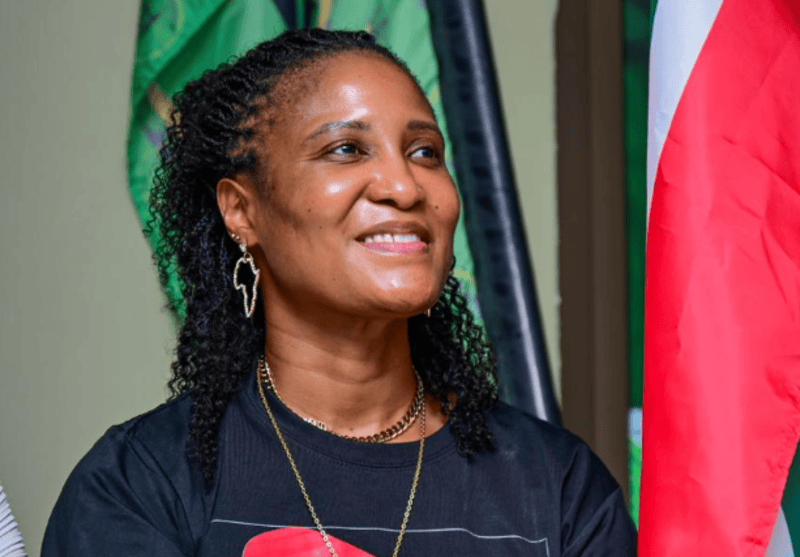

Auditor General Nancy Gathungu has uncovered substantial financial discrepancies at the National Cancer Institute of Kenya, which has an operating budget of approximately Sh140 million.

In the audit report for the financial year ending June 2023, Gathungu highlighted several inaccuracies, including unsupported expenditures, inaccuracies in financial statements, arithmetical errors in budget comparisons, and unsupported expenses, revenue, travel allowances, and bank balances.

More To Read

- Auditor General calls for penalties on officers who ignore audit recommendations

- Auditor General Nancy Gathungu warns of pension losses as government delays remittances

- Revenue gaps, budget misalignments hurting service delivery, warns Auditor General

- Auditor General warns Kenya Railways’ Sh569 billion loan default could burden taxpayers

- Kenya wins bid to host 2027 World Cancer Leaders’ Summit

- Audit uncovers Sh13 billion irregularities in Ketraco wayleave payments

She noted that while the financial statements reported expenses of Sh163,526,082, seven components totalling Sh161,775,258 had schedules reflecting only Sh128,355,123, leading to an unexplained variance of Sh33,420,135.

The expense for conferences and delegation was listed as Sh23,062,879 but had schedules of Sh14,966,229, resulting in a variance of Sh8,096,650, while advertising expenses totalled Sh19,729,549 with schedules of Sh14,712,529, leaving a Sh5,017,020 discrepancy.

Bank charges were reported as Sh147,628 with schedules of Sh65,887, creating a Sh81,741 variance, while printing and stationery expenses amounted to Sh4,322,050 but had schedules of Sh1,264,500, resulting in a variance of Sh3,057,550.

The expense for cancer education materials was Sh30,047,600 with schedules of Sh21,653,200, leading to a Sh8,394,400 discrepancy.

Travel accommodation and daily subsistence allowances were reported as Sh80,931,996 with schedules of Sh75,059,778, resulting in an unexplained variance of Sh5,872,218.

"In the circumstances, the accuracy and completeness of the respective expenditure amounts could not be confirmed," Gathungu said.

The audit also uncovered public contributions and donations amounting to Sh29,603,994 and services rendered for Sh9,772,236, but they were also not backed by schedules, leaving an unconfirmed expense of Sh39,376,230.

Gathungu also scrutinised the institute's cash and cash equivalents balance of Sh27,372,282, including a current account amount of Sh16,915,180, noting that they lacked supporting documents like a cashbook, bank balance certificate, and bank reconciliation statements.

"In the circumstances, the accuracy and completeness of the cash and cash equivalents balance of Sh16,915,180 could not be confirmed," she said.

Regarding receivables from non-exchange transactions, the audit identified an omission of outstanding imprests totalling Sh8,141,287, raising concerns about the completeness of the reported figures.

Under budgetary control and performance, Gathungu noted that the institute exceeded expected receipts by Sh135,142,897, collecting Sh275,542,897 against a planned Sh140,400,000.

On the expenditure side, it overspent by Sh87,507,282 from an approved budget of Sh85,994,000.

"There was no evidence of approval for this over-expenditure," Gathungu said.

The audit report also noted that, as of June 30, 2023, the institute owed Sh22,493,943 for goods and services received, including unpaid bills for supplies and audit fees.

Gathungu warned that failing to settle these bills on time distorts financial records and adversely affects budget planning for subsequent years, as these unpaid amounts are prioritised for payment.

Top Stories Today